You can read the thesis in Spanish here:

Note: this is the original thesis. You can access updates and new news about the company in the “Updates” section or at the end of this thesis, where you will find a link to all the updates.

Introduction

The mining industry has disappointed many investors through the decades. Mining companies can only focus on a few properties which have high development costs only to face many risks while the mine is operating. Among them are strikes, mine floodings and financial problems (need for further liquidity, high leverage, etc.). These risks can have a very significant impact on the companies and damage shareholders and their profits. Nevertheless, there are a few good companies in this sector and among them is Gold Royalty.

What is Gold Royalty’s business?

Royalty Model

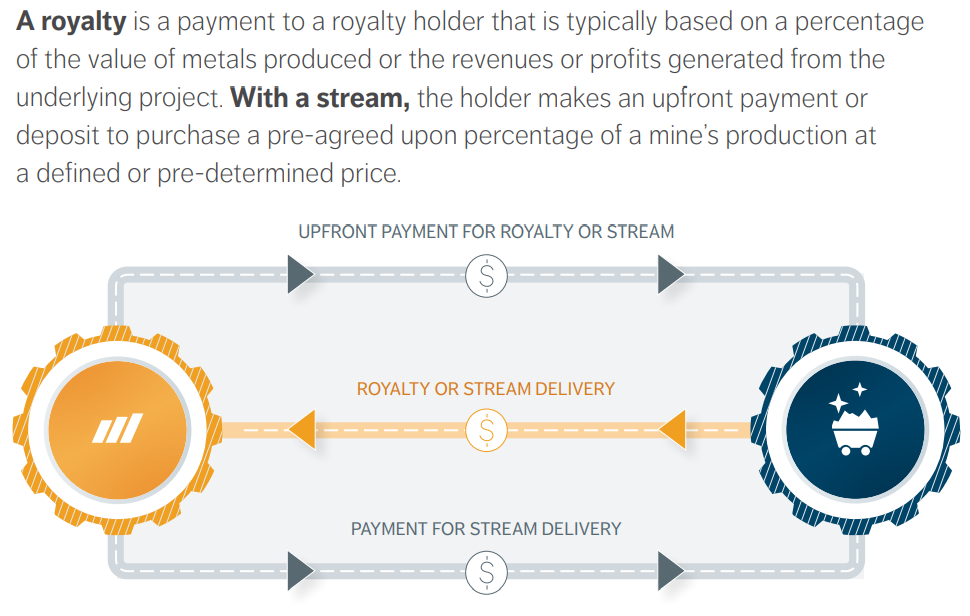

The royalty model is fairly new in the mining industry. The royalty company provides financing in the early stages of the mining project and the mine operator gives a royalty in exchange once the mine is producing. The contribution of the royalty company is typically financing for Preliminary Economic Assessments (PEAs) or other exploration or development activities that need capital. Banks usually avoid providing the money for these because of the risk and credit profile of most mining companies.

The royalties can take various forms:

Net Smelter Royalties (NSR): “a right to receive a certain percentage of the revenue directly from the smelter” (Sandstorm Gold Royalties CEO). The royalty is taken from the revenue, without accounting for production costs.

Net Profit Interest (NPI): “the royalty holder gets a certain percentage of the profit from a mining company”. (i.e. the royalty is taken after all other expenses are deducted. In the case of mining companies, it is fairly common for them not to make a profit during some years because of the problems discussed above.

There are several other types of royalties that haven’t been discussed, as they are a minority in Gold Royalty’s portfolio.

Here is the CEO of Sandstorm Royalties to explain how royalty companies work:

Note: Sandstorm is a competitor of Gold Royalty, which will be discussed later.

The royalty model provides many advantages:

It is a contractual business. There is no need for working capital or equipment, all it takes are offices with a few employees to review contracts and supervise how underlying properties are developing. Gold Royalty has said that they “can manage a business ten times this size with the same people”. It is an easy business to operate and royalty companies have one of the highest revenue per employee ratios.

All the capital is already deployed. Once the contract is signed, there are no further commitments from the royalty company, all it has to do is wait and collect the payments. This means no capital expenditures are required to grow the organic revenue, it is only needed to sign new royalty contracts.

Exploration Upside. The royalties cover all the gold extracted from a predetermined surface area. If mining companies do further excavations on that land or update their resource estimates, the royalty contracts cover those minerals and royalty companies do not need to pay anything, those new resources are already covered by the contract. It is important to note that the royalty holders are entitled to receive the payment once the gold is extracted from the ground and processed.

Gold Price Exposure. Were there to be a rally in the price of gold, royalty companies will also benefit from it without having to pay a dime. In this inflationary environment, where fiat currencies are devalued, gold holds its purchasing power and therefore the price of gold expressed in dollars rises during these times. I believe it is possible that we live through another inflationary period in the coming years. If this happens, gold royalty will benefit from it. If it does not nothing in these thesis changes. I have assumed constant gold prices for this thesis.

Top-Line share of profits. The most typical royalty is NSR (for Gold Royalty), which means that it does not matter if the mine operator or the mine itself are profitable, the royalty holder receives its share first and then all the production costs, salaries, etc. are paid. The royalty is the first thing to be paid.

In this page, GR briefly describes their business model:

Short History

Gold Royalty (also referred to as GROY or GR) was created in 2021 as a spinoff of GoldMining Inc. GoldMining created royalties on 15 of their properties and gave them to Gold Royalty.

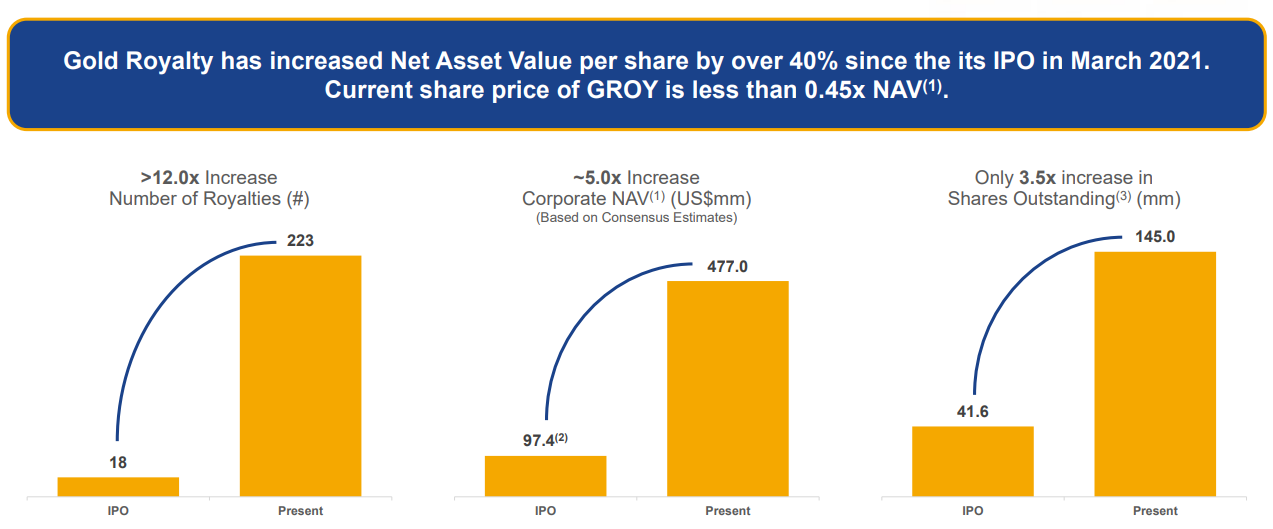

After the IPO, GR started growing their business via acquisitions. They acquired 3 companies (Abitibi Royalties, Golden Valley Mines and Royalties and Ely Gold Royalties) and did another 4 transactions. They now own over 240 royalties.

They also acquired a few royalties in individual transactions and signed some option agreements, which will be explained below. Among them is the Cozamin royalty, which was bought to provide more immediate cash flows. Cozamin is expected to provide $1M in annual royalties.

The acquisitions have been paid for mostly with GROY’s shares, thus increasing the share count significantly. Nevertheless, they have managed to achieve that growth while creating value per share, which is up 40% since the IPO, according to analyst estimates.

Competitive Advantage

Contracts: No competitor can take away Gold Royalty’s revenues as the contracts are signed and all paid for. There can be additional contracts on the same property but as long as GR owns the contract it is fully entitled to the royalty.

Diversification: Many companies in the mining industry have very low diversification in terms of mining properties. So do some royalty companies. GROY owns over 240 royalties. Most of them are not producing yet but it is expected that in the next few years about 10 properties will be producing. As more and more properties enter production, the diversification effect will grow and revenues will become much more stable.

Gold Royalty explains other competitive advantages here:

Management Team

When researching mining companies it is crucial to review the management team. In the case of Gold Royalty it is not as important because of the royalty model. Nevertheless, it is still important as they are the ones taking care of capital allocation.

The key figure is David Garofalo. He was the President and CEO of GoldCorp, one of the biggest mining companies, until its merger with Newmont, a transaction he directed. He has also served as Senior Vice President, Finance and CFO of Agnico Eagle Ltd. and has had management positions in several other mining companies over the last 30 years.

GR has many directors and managers, but most of them do not work full-time in GR as the day-to-day operations of the business are very simple. Their role and influence on the company are more limited.

Royalty Portfolio

Gold Royalty owns over 240 royalties. Most of them are in exploration or advanced exploration, several in development and a few are producing. The royalties can cover several resources, for GR gold represents 94% of their royalties, copper 5% and 1% other minerals. 54% of those resources are located in Canada and 33% in the US, with the other 13% being mostly in South America.

Key Assets

Gold Royalty owns a few assets that are key to its future because of their size and the timing of the initial production. These assets are: the Odyssey Project (part of Canadian Malarctic), Côte Gold and the REN Project (part of Carlin Complex).

The Odyssey Project is a part of the Canadian Malarctic Mine, more specifically the underground part of a specific area. GROY holds a 3% NSR over this project. This royalty has just started producing in Q2 2023 and it is expected to produce 50koz in 2023 and 80koz in 2024. This translates into 1,500 ounces of royalty in 2023 and 2,400 in 2024. At the current gold price of $2,000 GROY’s revenues will increase by $3M in 2023 and $4.8M in 2024. This is an important addition to the producing royalties and should push the company into profitability. By the end of 2024, this mine will cover more than half of Gold Royalty’s recurring operating expenses, which are expected to be about $8M. Based on current resources and processing capabilities, the mine should last until 2042.

Côte Gold is in the last stages of development, when the required equipment is built and prepared for production. IAMGold, the operator of the mine, has said that construction is over 86% complete and initial production in early 2024. The royalty covers 0.75% NSR over the southern portion of the mine. The entire mine is expected to produce 495 koz in the first six years and 365 koz of average production for the life of the mine, which is expected to last until 2041.

Producing Assets

GR currently has 5 producing assets: Canadian Malarctic, Odyssey, Borden, Isabella Pearl and Cozamin. Canadian Malarctic is the 2% NSR on the Charlie and Gouldie parts of the mine (see map). Odyssey, which has already been discussed, is the 3% NSR on the Odyssey shaft.

Borden is expected to produce 100 koz annually and the mine is expected to last at least until 2027. Gold Royalty holds a 0.5% NSR over the underground part of the mine. It is operated by Newmont.

Isabella Pearl is a different type of royalty, a GRR. In a GRR the royalty holder is entitled to a fixed portion of the gross revenues generated from the sales of mineral production from the property. Gold Royalty owns a 0.375% GRR over this mine, as well as another 2.5% on the Isabella Pearl Extension, which is currently in the early exploration stage. Isabella Pearl is expected to produce 40 koz per year until 2026 at least.

Cozamin was recently acquired by GR for $7.5M. They hold a 1% NSR royalty over the silver mine, which yields about $1M annually. They expect this operation to have a ROI of 8.5% to 12.5%. It was done to enhance near-term cash flows. The mine could last until 2036.

Other Assets

Other interesting assets are:

REN Project: royalty of 1.5% NSR and 3.5% NPI which is currently in development, with the developer aiming to incorporate the mine in the short term.

Granite Creek: 10% NPI payable after 120,000 ounces have been produced. The mine is currently producing but the royalty is not, as the 120,000 oz level has not yet been reached.

Jerryt Canyon: 0.5% NSR and scaled PTR (per ton royalty, a royalty paid based on the number of tons processed by the facility). They suffered a strike and the operator decided to shut down the mine until 2025.

SOQUEM Acquisition: Gold Royalty purchased from SOQUEM 22 royalties located in Québec for CAD $1M payable in GROY shares. Included in this transaction, GR acquired the right to receive a payment of CAD $1M once a positive PEA (Preliminary Economic Assessment) is published on the property called "Probe Gold's Detour Project". SOQUEM will be entitled to 50% of any buyback proceeds received from the portfolio in the future, which totals CAD $18.2M. For this to happen the operators of the mines would have to exercise their buyback rights, if they don't then SOQUEM is not entitled to any payment. This transaction was made on November 1st 2023.

GROY provides a comprehensive list of all of their royalties and has developed an Asset Handbook detailing all of them.

A Look at the Numbers

Revenues

The revenue for Gold Royalty comes from royalties and options. Currently, the revenue from options makes up an important part of total revenue, but as more assets enter production, the proportion of option revenue will decrease. GROY gives options to other companies to buy some of their royalties in exchange for a payment. They are selling puts on their properties to generate short-term revenues.

Gold Royalty expects to grow revenue organically by over 60% annually until 2026 as key assets start producing and gradually increase production. This projection only includes organic growth.

Fixed Costs and Operating Leverage

GR’s costs are about $8M annually. Right now those costs are making the company unprofitable. Nevertheless, almost 100% of these costs are fixed. Once royalties start to come in, the relative size of the costs will go down dramatically. David Garofalo (CEO) has said multiple times that they can “run a business ten times this size with the same people”. This translates into huge operational leverage in the short and medium term and it is the reason why they expect the company to reach profitability in 2024.

It is likely that recurring operational costs will grow higher than $8M, nevertheless they will grow much slower than revenues, resulting in higher margins.

Other Matters

Stock options are providing the company with about $3.4M in cash. They are part of the executive compensation plan. The stock option payments are expected to continue in the near future.

With regards to the balance sheet, they hold $5.7M in cash and equivalents and most of the assets are the “Royalty and other mineral interests”. They also own about 40% of Val d’Or Mining. GR has a revolving credit facility of $20M maturing in March 31, 2025 from which $10M have been drawn. The credit agreement includes the possibility of an extension of $15M if certain conditions are met.

A few quarters ago, GR decided to pay a dividend in cash or shares. With the acquisition of Cozamin they decided to suspend any further dividend payments to “focus capital on existing opportunities”. Them paying a dividend without producing positive cash flow didn’t make much sense in the first place and it is good that they cancelled it. When they first approved it they were pressured by some shareholders. They will evaluate reinstating the dividend after positive FCF is achieved if they feel comfortable.

Growing the Royalties

“Our strategy is to continue to build upon our diversified precious metals focused royalty portfolio, by acquiring third party royalties, financing the development and production of new or existing mines, pursuing accretive corporate M&A opportunities, and generating new royalty through our royalty generation operations. In doing so, our goal is to grow our net asset value per share and to generate value for all of our stakeholders over time.

We focus on acquiring precious metals royalties, streams and similar interests on mines and projects at varying stages of the mine life cycle to build a balanced portfolio offering near, medium, and longer-term growth in underlying net asset value per share.

As part of our strategy, we expect to utilize a cost-efficient business model by operating with a small, but highly experienced team and calling upon third-party resources to supplement our skill set as opportunities may arise. This strategy enables us to maintain a high degree of flexibility in our cost structure. This business model is scalable and allows us to seek new growth opportunities in a cost effective and value enhancing manner.”

Royalty Generator Model

They have also developed a proprietary royalty generator model that has created 37 new royalties since the IPO in 2021 and keeps generating 2 or 3 new royalties per quarter.

It works as follows: “Jerry Baughman, he stakes exploration claims around existing mines, existing deposits, waits for the neighbors to knock on the door and says, yes, you can have the property, but you’re going to have to pay me an option payment, you’re going to have to make a work commitment on the property and you’re going to have to give me a royalty”.

This way they “get paid to generate royalties” and they make sure that those properties are developed. The total cost for the royalty generator model is $160,000 per year.

Risks

Despite the many advantages of the royalty model, GR faces some risks:

Mining Risk: as the producing royalties are still few, operational mining risk still poses a threat to GR’s revenue in the short to medium term. This risk will gradually fade as the pool of producing royalties gets more and more diversified.

Gold Price: a bear market in gold can affect revenues negatively.

Broken Contracts: should an operator challenge the royalty contract, the company would be forced to take legal action against the operator and incur in legal costs.

NPI Contracts: the NPI royalties entitle the owner to a portion of the benefit of the underlying mine. If this mine becomes temporarily unprofitable, GR stops receiving royalties.

Takeover risk: they are subject to be bought out by a larger competitor. There is little they can do to mitigate this risk. The only thing that could protect GROY from a takeover is a good share price performance, which it has not had recently. Among the reasons given for this (by management) is that the market is heavily discounting growth companies and they do not yet generate FCF.

Competitors

There are two types of royalty companies, big ones (over $1B) and small ones (below $250M). Some of the big ones are:

Royal Gold is the most similar competitor to Gold Royalty in terms of the minerals covered by the royalties. It is a $7B company trading at 30x earnings and x16.5 free cash flow. It is much bigger in scale ($600M in revenue) but the business is very similar. There are few variations to the business model other than Royal Gold is a much more established company with more limited growth opportunities. In 2000 and 2001, Royal Gold was receiving $6M and $12M respectively and its market cap was about $200M, a very similar situation to Gold Royalty now. Plus, GR’s expected growth profile is very similar to what Royal Gold did in the 2000s. Since 2000, Royal Gold’s stock has returned 17.6% annually without accounting for dividends or dividend reinvestments.

Franco Nevada is the biggest company in the royalties space with a market cap of $25B, which translates into x35 earnings and x25 free cash flow. Their portfolio consists of 65% gold, 11% silver, 11% oil and the rest are other natural resources. They IPO’d in 2007 with $180M in revenue and the stock has returned 15% annualized since the IPO (without dividends or dividend reinvestment).

Sandstorm Gold Royalties is the smallest company among the big royalty companies. Their market cap is $1.35B, with a p/e of 33 and p/fcf of 13.5. Their portfolio is 50% gold, 21% silver, 20% copper and 10% others. The stock has returned 14% annualized without dividends or dividend reinvestment.

In the small space, there are only 4 companies since Gold Royalty and other companies have consolidated the sector in the past few years. One of them is Gold Royalty, the other 3 are:

Metalla Royalty & Streaming has a portfolio of 105 royalties with 6 of them currently producing. The portfolio is 46% gold, 42% copper, 9% silver and 3% others. Half of the resources are located in North America and 40% in South America. 2023 to 2025 expected revenue CAGR is 142% after its merger with Nova Royalty. They do not make a profit yet. Its price to royalty assets is x1.23

Vox Royalty Corp. has a portfolio of 70 royalties, with 6 of them producing. Their market cap is $100M and 2023 expected sales is $12M. They are not yet making a profit. Price to royalty assets is x3.1. They IPO’d in 2020 and the stock is flat so far.

Elemental Altus Royalties IPO’d in 2020 and the stock has declined 33% since. Currently their market cap is $220M. Their portfolio consists of 90 royalties, with 10 producing. Gold represents 70% of NAV and copper is 30%. They have very few properties in the US and Canada, most of them in Australia, Chile and Africa. 2023 expected revenue is $17M. They do not make a profit yet. Their price to royalty assets is x1.6.

Note: Gold Royalty’s price to royalty assets is x0.27

Comparison of royalty by metal and by geography:

Valuation

The valuation in this industry is quite complicated. The price to Net Asset Value is typically used but there is a problem with it. The companies recognize net asset value, which is mostly the value of the royalties, differently. Nevertheless, it is somewhat valid to assess the valuation of these companies.

Using it, we can see that Gold Royalty is quite undervalued compared to its competitors:

Note: Market Capitalization (x-axis) is in a logarithmic scale.

Observing the valuation of the different companies in the royalty space we reach the conclusion that the P/NAV does not give the full picture. There are other factors that influence the valuation like the cash flow the company produces, the growth prospects, the size of the business, whether or not it pays a dividend and the quality of the company’s royalty portfolio. Most companies have royalties divided over several metals, not just gold, and that also plays a role in their valuation. The company with the most similar “mineral mix” is Royal Gold.

It is quite difficult to assign a numerical value to the fair price of Gold Royalty, but we can say that it is severely undervalued.

We can do a quick exercise to estimate revenues, earnings and EPS. Here we assume a 65% growth until 2026 and 40% growth for the next 2 years, as well as costs increasing and some share dilution.

Net Asset Value is not expected to vary much through the years but EPS will. To make an adequate estimate we have to take into account all the factors mentioned above and it is possible that we are off in our estimate. Nevertheless, we can see that the company is undervalued.

Conclusion

Gold Royalty Corp. operates in a very interesting industry with many good qualities. It should have impressive revenue and earnings growth in the next years without having to do much or spend any money. Risks are fairly limited and they can benefit from exploration upside and gold price exposure. Plus, the company appears to be trading at a depressed valuation in comparison to its competitors.

Disclaimer

This article is not a financial advice. I am not a financial analyst. If you are going to invest do it under your own risk and after doing the appropriate due diligence.

Updates

In this section you can find the most relevant news and updates from the company since the thesis was published. They are arranged in chronological order: