You can read the Spanish version here:

In this post I will dive into the recent developments, news, outlook and other relevant information of the following companies:

Gold Royalty GROY 0.00%↑

Titanium Transporation $TTNM

I will publish another post with the results of the rest of the companies in the next month.

Gold Royalty

You can find the original thesis for Gold Royalty here:

Gold Royalty recently published their FY 2023 results but much more importantly their revenue guidance for 2024. They expect to receive between 5,000 and 5,600 Gold Equivalent Ounces (GEOs), which then multiplied by the gold price gives the revenue in dollars. Considering that gold is trading above $2,200/oz, revenue for 2023 should be around $11.7M at mid-point guidance, doubling the revenue from 2023.

Note: revenue to only includes royalties but also options payments and revenue from land agreements, which the company considers revenue from its normal operations but is not accounted in the income statement as revenue because of accounting rules.

G&A cash expenses were $8M for the year, a 36% decline from 2022, which is expected to remain stable in the coming years. The reduction in G&A expenses was possible thanks to the integration of several other royalty companies acquired since their IPO.

Recent Portfolio Developments:

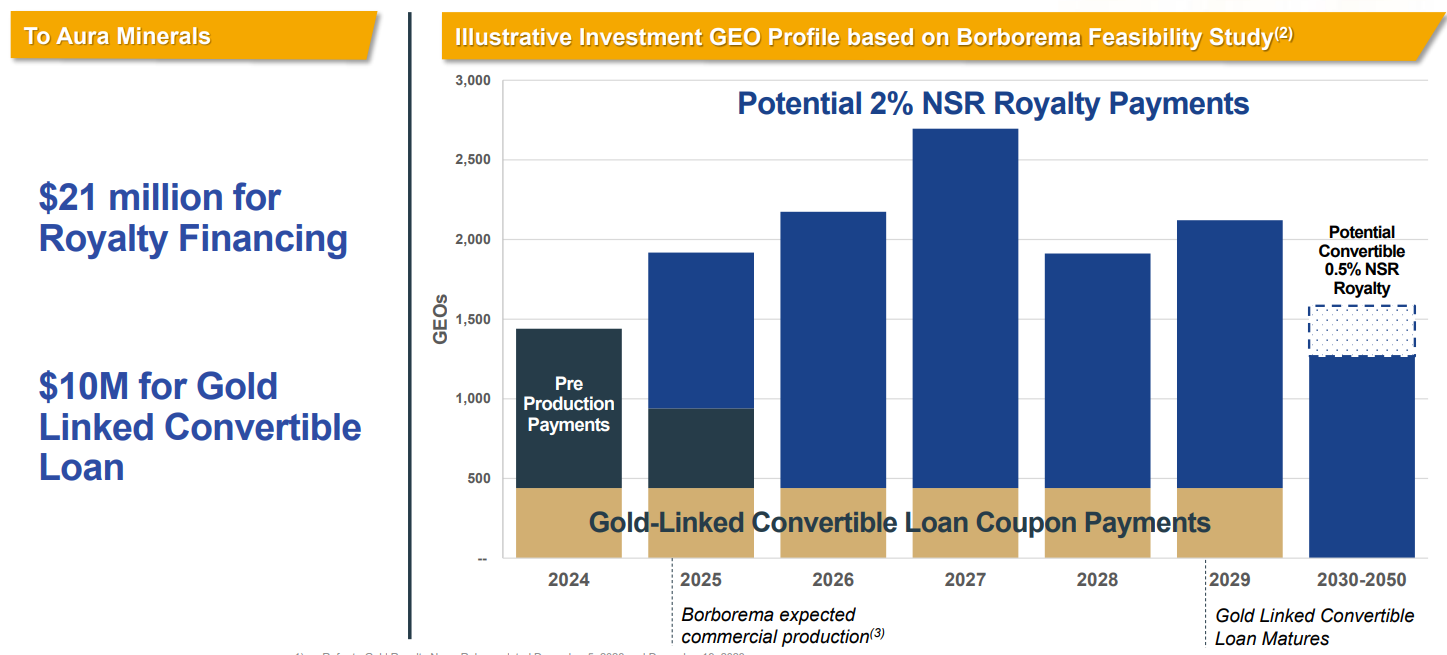

On December 5th Gold Royalty acquired a 2% NSR in the Borborema project in Brazil for $21M. The royalty will decrease to 0.5% NSR after 725koz have been produced and that remaining 0.5% will be subject to a buyback of $2.5M after 2,250koz are produced or in 2050, whichever one comes first. The royalty includes pre-production payments of 1,000 oz per year until production starts, which is expected for 2025. This provides GROY with immediate cash flows.

Additionally, they provided financing to the operator for $10M in the form of a royalty-convertible gold-linked loan, which has coupon payments payable in gold of 440 oz per year. Gold Royalty can convert the gold-linked loan into an extra 0.5% NSR upon maturity. That 0.5% is subject to buyback under the same conditions as the 0.5% related to the royalty.

To finance the Borborema acquisition, the company borrowed $40M via unsecured convertible debentures. They have a maturity of 5 years at a 10% interest rate, of which 7% is payable in cash and 3% in common shares at $1.90 per share. In addition to that, the lender can be convert the loan into shares at maturity at a price of $1.75 per share.

Regarding the key assets, Côte Gold was expected to start production in the second half of march, so production should have started by now. For 2024, the mine will produce 220koz to 290koz, for an equivalent 1,500 royalty ounces, since the royalty does not cover the mine entirely. Commercial production is expected by the end of Q3. For Canadian Malartic, further ramp-up of the underground part, the Odyssey Project, is expected in 2024, although it depends more on the production plans of the operator.

This changes leave the portfolio like this:

On a final note, I expect that GROY will earn about $1M, given the revenue guidance and the recurring $8M in G&A costs, $2.8M in interest from the Borborema debt and another $0.7M in interest from the bank loan. I do expect revenues to be higher than mid-point guidance driven by both higher GEOs and a higher gold price, with an estimate of about $12.5M.

Titanium Transportation

You can find the original thesis for Titanium Transportation here:

Titanium recently presented their FY 2023 results, missing the lower end of guidance (which was $450M) with $440M in sales but giving exactly the mid-point guidance EBITDA with $52.9M. This translated into higher EBITDA margins of 13.8% vs upper-end guidance of 12.5%, driven by the trucking segment achieving 19.7% margins despite the integration of Crane. Adjusted Net Income was $12M, which leaves Titanium trading at x9 earnings or x5.3 EV/EBITDA, with expected good EBITDA and net income growth and further deleveragement.

Titanium’s management team expects the market conditions to improve in the second half of 2024 and they have seen early signs of this improvement with the trucks to load ratio coming down from 4 to 1 to just 2 to 1 as excess carrying capacity exits the market.

However, being a conservative management team, they decided to provide guidance without the expected improvement in market conditions. The guidance for 2024 was $490M to $510M in sales with EBITDA margins of 10% to 12%, with an implied 3% organic growth rate. They also expect capex of $10M, $4M lower than what they said a couple of quarters ago. Taking into consideration expectations of revenue, margins, capex and historical cash conversion, I expect them to generate approximately $28M in FCF.

Finally, I would like to share some interesting comments made on the last conference call

“I believe that we entered 2024 from a position of strength and will now focus our free cash flow on improving our balance sheet following the acquisition of Crane”.

“We are conservative by nature in terms of how we run the business”.

When asked about what leverage ratio they feel comfortable with and what acquisitions they are seeing in the market Ted Daniel (CEO) answered:

“I actually get excited with this question. I enjoy it because I don’t like a levered balance sheet. In fact, I guess I’m a little old school. I’m new school because I love tech and I love developing and innovating. And definitely, that’s one part of me. But the other part of me is the accountant in me, which says, I love a really, really strong balance sheet where you can show up and write a big check for an amazing opportunity where we’re going to do an acquisition”. … “However, on a post-acquisition basis, we end up 3 to 1, and we do that strategically, and then we find a way to quickly pay it right back down so we’re ready to do that again”

I expect Titanium to perform well in the coming years and generate more and more cash which will be used efficiently, as it has been used so far, and I reiterate my opinion that the business will be worth $8 to $10 in 2 to 3 years.

Disclaimer

This article is not a financial advice. I am not a financial analyst. If you are going to invest do it under your own risk and after doing the appropriate due diligence.