You can read the thesis in Spanish here:

Note: this is the original thesis. You can access updates and new news about the company in the “Updates” section or at the end of this thesis, where you will find a link to all the updates.

History and Business Model

Business Model

Titanium Transportation $TTNM is a trucking company with two segments: Logistics and Transportation. Titanium conducts its operations in Canada and the United States, with numerous cross-border operations. The segments have different but complementary activities. The specific activities are:

Trucking Transportation Segment: through this segment Titanium offers full truck load (FTL) transportation services to its clients. Titanium also leases trucks to independent truck drivers, which fall under this segment. This segment requires a lot of capital to pay for the trucks and trailers.

Logistics Segment: through this segment Titanium provides logistics services to truck drivers and customer who want to transport cargo. Through their platform and logistics services, they connect trucks, freights and customers for a commission. This segment relies in technology and network effects and as such is asset-light.

After the latest acquisitions, Titanium operates 1,000 power units (truck heads), 3,600 trailers and 10 trucking terminals, 8 in Canada (156 acres) and 2 in the US (22 acres).

History

Titanium was founded in 2002 by the current President & CEO, Ted Daniel. They started doing acquisitions in 2011 while continuing to grow organically. They went public in 2015 and kept acquiring companies and growing organically. They have since grown their revenues to $500M.

Market

The company operates in two different markets. The truck transportation market is US$900B+ in size and it is highly fragmented with 87% of US trucking companies operating less than 6 trucks and being unable to connect with top customers. In the US there are 1M trucks for hire and 0.9M of private/other carriers. All of this shows the high fragmentation of the trucking market. The same is true for Canada, with 65,000 trucks for hire and the top 100 carriers only accounting for 6% of all Canadian trucks. As could be expected, the trucking market is a mature one and its annual growth is about 3% per year, the same as the economy.

There are two types of carriers, those that Full Truck Load (FTL) and those that do Less than Truck Load (LTL). Titanium does FTL, as do most companies in the industry, since doing LTL requires a significant volume of transactions and logistical and technological capabilities that these companies do not have.

The logistics market is very similar in size to the truck transportation market, about $1T but it grows at the slightly faster rate of 4.5% per year. It is important to note that for both industries the margins are a function of scale.

Competitive Advantage

Titanium currently enjoys a few competitive advantages and some of them will keep widening as the company grows. These are:

Scale & Network effect: as the company grows and acquires more trucks and trailers, they are able to offer more routes as they grow their network. This effect only keeps getting stronger and stronger as the company grows.

Technology: the company’s technology is a competitive advantage as most carriers do not have the ability to manage a logistics business or create an application for their carriers.

Financial Overview

The company trades in the Toronto Stock Exchange and as such reports its numbers in Canadian dollars and is exposed to variability in exchange rates.

Historical Performance

Since the IPO in 2015 the company has increased its revenues 4 times and its EBITDA 5 times. Net income has been more volatile, especially in 2022 and 2023 when as a result of distribution bottlenecks and increased freight costs the company experienced an extremely profitable 2022 and as a result of macroeconomic uncertainty, mainly regarding interest rates, the company suffered with falling revenues and profits for 2023.

In the last 5 years the revenues and EBITDA were:

Revenues and Profitability

The revenue by segments is:

However, after the acquisition of Crane Transport (discussed below) the revenue mix went to 50/50. They have said that they will increase the logistics revenue in the coming years. A long-term accurate revenue mix is 60% logistics and 40% trucking.

Regarding the logistics segment, it is mainly a US business and is technology focused. This part of revenues is more volatile since the revenues are a consequence of costs and the margin they are able to add, rather than the market price. In a recent conference call, Ted Daniel, stated that “logistics is more of a cost-plus business”. The locations are:

In the trucking segment, the company has both warehouses and trucking terminals. The key financials for the last 5 years and the locations appear below (locations include the recently acquired Crane locations).

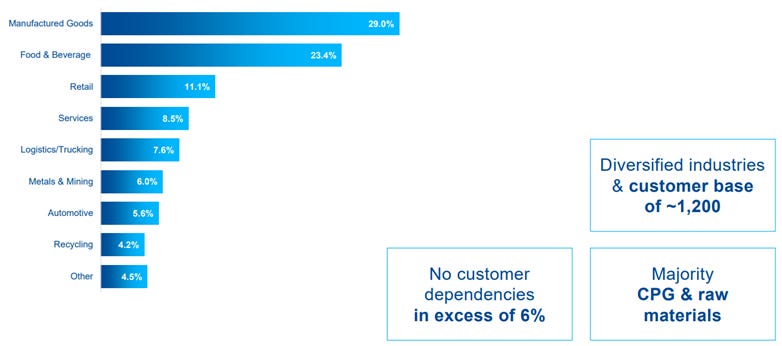

The trucking segment has stable revenues, with 90% being contracted. This stability comes from the mix of products transported by Titanium, which is the following:

There is also a seasonality factor with Q4 being the best quarter, Q2 being the second best, then Q3 and lastly Q1.

Balance Sheet

The company currently has a net debt to EBITDA of x2.95 (without leases) and a net debt to equity of x1.7. The limits the company sets for leverage are x3 net debt to EBITDA (without the leases) and x3.5 net debt to equity. Leverage should fall quickly though as they grow organically, improve Crane’s margins and Crane contributes to EBITDA more (only 5 months consolidation for 2023).

The equipment on their balance sheet is typically recorded below market value and as a result when it is sold there is a gain on disposal of equipment. The equipment are trucks and trailers. They are sold when the company deems that it is appropriate in order to maintain a modern fleet.

Cash Flows

Titanium goes through ‘equipment replacement cycles’ which result in capex cycles. During these cycles the company sells their older trucks and trailers and purchase new ones. This creates a lot of volatility in capex. The replacement cycles lasts 1.5 to 2 years and the operating cash flow generated by the company goes towards paying that fleet renewal. Nevertheless, during the other years in the cycle, approximately 2 years, the company has minimal capital expenditures.

They have just finished their last capex replacement cycle and so their capex will be about $14M per year for the next 2 years. Titanium has estimated that a normalized level of capex is about $40M per year.

It is important to note that after the replacement has taken place, the trucks have usually cost more than the older trucks and as such they have higher depreciation in dollar terms, which affects EBITDA.

Growth Strategy

Targets

When Titanium was making $100M in revenue they established the target of $500M, which was reached in 2022. Now their plan is reaching $1B in the next 5 years (by 2028). They also targeted to have 10 US logistics locations by 2024. They are on track to meet this goal, although one location may be opened in the first quarter of 2025. In 2023, they revised their guidance due to macroeconomic circumstances, but those are not a long-term problem. This is expected to happen some years since the industry is cyclical.

Growth Plan

Historically they have grown acquiring asset-based (i.e. truck transportation companies) and then improving their margins and leveraging the relationships with the clients to expand their logistics business. As was explained above, the market is hyper-fragmented so acquiring further trucking companies shouldn’t be a problem.

In their investor presentation, they state that “20-25 locations expected to result in ~$500M revenue opportunity”. This means that each location generates $20M to $25M in sales. The set-up costs per office are $0.3M, so the investment is minimal.

They plan to reach the 2028 goal by increasing the logistics locations in the United States and making a further 1 to 2 asset-based acquisitions similar to Crane, their last acquisition. In a recent conference call, they stated that they plan on “growing the logistics business aggressively”. As a result, they have opened 2 locations in 2023 and they will open another 3 in 2024.

Historical & Recent Acquisitions

Titanium has made 13 acquisitions since 2011. They have purchased asset-based trucking companies (the logistics part grows organically) that granted the company access to new geographic areas and to new customers. Their maximum multiple is x6 EV/EBITDA before synergies, which results in them paying a low goodwill. They also search for an aligned company culture. With each acquisition, they implement a standardized integration process that lasts 1 year, with the industry’s average being 2 to 3 years.

The total cost of the acquisitions was $239.5M (including Crane) and the acquired revenue per company was:

Their latest one, Crane Transport, was their first US asset-based acquisition. Crane does FTL interstate. They paid US$53M dollars for the company and US$6M for the Real Estate on which Crane operates. The acquisition was financed with US$33M in cash, US$14M in assumption of net debt and $12.4M in a vendor take-back loan. The payment represents a x0.9 P/S and x6 EV/EBITDA pre-synergies. Crane had EBITDA margins of 14% - 15% while Titanium’s are 18% - 19% (for the Trucking segment). Crane’s trucks are in good condition.

After the acquisition of Crane, the revenue is roughly 50% logistics and 50% trucking. This allows Titanium to leverage the acquisition to expand its logistics operations and push the logistics share of revenue to 60%. The acquisition also makes Titanium a more US-focused business, as more than 60% of revenues are now from the US.

Once Crane is integrated into Titanium they will start selling their logistics business in the new US locations more aggressively as they now have the ability to offer a better brokerage service to US customers. They have said that “this is going to have exponential potential over the next 1 to 2 years”.

Insiders & Shareholder Returns

Insider Ownership & Management

Regarding insiders, the President & CEO Ted Daniel owns 7.2% or 3.2M shares. The company also considers the Zzen Group (Trunkeast) as an insider and they own 27.7% or 12.4M shares. Trunkeast is a venture capital firm that invested in Titanium from the beginning.

They also try to incentive employees with a ‘driver and employee share purchase plan’.

Regarding management, the key figure is Ted Daniel, the President, CEO, Director and Co-founder of Titanium. He founded Titanium in 2002 and has led the company since it was a start-up to a $500M revenue company. Ted is a Chartered Accountant, and he also holds a bachelor’s in computer science. Before Titanium, Ted Daniel led multiple turnarounds and restructurings in the role of CFO in a 10 year period, which included 3 years in a mid-sized transportation company where he learned a lot about the industry. Other important managers are Marilyn Daniel, COO and Co-founder, who is in charge of operational processes and acquisition integration, and Alex Fu, the CFO and responsible for capital allocation.

Dividends & Share Repurchases

When it comes to returning capital to shareholders, since 2020 they have been paying $0.08 dividend per share, and they have started repurchasing shares (NCIB program) but because of the low volume in the stock they have reached the NCIB maximum (20% of daily volume) and they are not allowed to repurchase more.

Risks

Many of the risks that Titanium suffers are risks associated with the industry and not so much the company in particular, nevertheless the key risks are:

Acquisition integration: they may run into some unexpected problems while integrating the acquired companies or they may do a big acquisition that could negatively impact the company’s future. Nevertheless, I believe this risk is minimal since they have already made 13 successful acquisitions.

Software Problems: the company has developed several software platforms for their carriers and for their logistics business. Any problem arising from this software could damage the company’s profitability and relationships with its customers.

Recessions: with recessions or generalized macroeconomic uncertainty, transportation volumes tend to decline and as a result the revenue of truck transportation companies. This happened in 2023, and the company took advantage of the lower valuations in the industry and the release of working capital to look for M&A opportunities.

Number of carriers in the market: the truck transportation market is very fragmented, and many actors enter and leave the market continuously. If many actors enter the market at some point, this will drop the price for truck transportation and reduce the company’s revenues despite the volume being the same.

Freight Costs & Fuel Costs: a small portion of the revenue comes from fuel surcharges, so a drop in fuel prices could lower the revenues with the company being unable to do anything to mitigate the damage. Regarding freight costs, they affect the price of truck transportation significantly and therefore a significant reduction in freight costs could damage revenues. In 2022 freight costs were at a record high and this resulted in big profits for the company, which is an example of the impact freight costs can have.

Competitors

The company has many competitors most of them are either significantly smaller or significantly bigger. Most companies tend to focus on one of the two segments in which Titanium operates: either logistics or truck transportation. In the logistics part the biggest competitor is CH Robinson and in the truck transportation part it is TFI International, Knight-Swift Transportation Services and Old Dominion Freight.

TFI is an LTL and FTL carrier, although most of the trucking revenue comes from LTL, and a logistics operator. They are the most similar company to Titanium among the big ones in the industry and it shows where Titanium can be in the future. They previously did just logistics and FTL, just as Titanium does now, and Titanium stated in a recent conference call that the natural evolution of the business is into LTL as they gain scale. TFI has 11,500 tractors and 38,000 trailers. (Titanium has 1,000 tractors and 3,600 trailers), so TFI is about 10 times the size of Titanium in terms of equipment.

Old Dominion is purely an LTL carrier with 11,300 tractors and 45,500 trailers. They also offer logistics services. Old Dominion is a much bigger company than Titanium or TFI, with a market cap of $40B. Finally, Knight-Swift Transportation has 22,000 tractors and 95,000 trailers so it is much bigger in size but nevertheless has a lower market cap ($9B) than Old Dominion. These two companies are not as comparable to Titanium currently nor in their past.

Valuation

Normally, these companies would be valued using P/E, P/FCF and EV/EBITDA but since titanium goes through the capex cycles, the FCF is significantly affected and the using P/FCF is no good. That leaves just P/E and EV/EBITDA with the latter being the most important metric in the industry.

Titanium provides the following table with companies in the industry, their revenue growth, margins and valuation. Nevertheless, the companies listed are significantly bigger than Titanium, with all of the industry leaders in them. Although it is not adequate for valuing Titanium, it gives a good picture of the industry and where Titanium can be in the future both in terms of valuation and margins.

The average EV/EBITDA for Titanium is x7 with the following evolution:

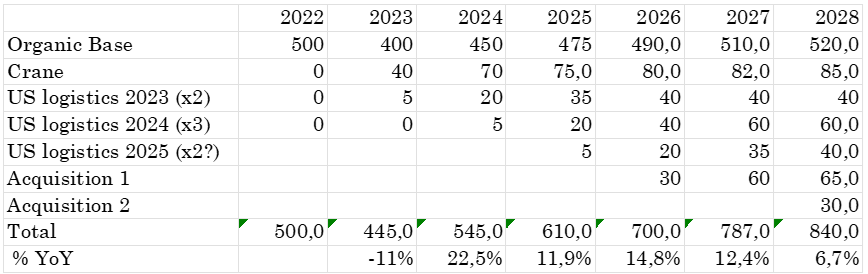

For the valuation of the stock I have prepared 3 scenarios. They are:

Optimistic: the previous revenues are mostly regained, Crane makes the same as last year and the logistics locations make $2.5M each the first year, when they are open for the full year, and then $20M. They also make a further two $100M in revenue acquisitions, with the first year being about half. The goal of $1B by 2028 is reached. Perhaps it is a bit too optimistic but in the end it all depends on the wider industry trends and how fast the market ends up recovering.

EBITDA margins gradually improve from 12% in 2024 to 12.5% in 2028. Regarding capital allocation, they make the acquisitions established in the revenue profile above and pay $70M for each, deleverage to x2 Net Debt/EBITDA by 2028. At x18 p/e and x7 EV/EBITDA we arrive at a $10/share by 2026 or $12/share valuation by 2028.

Neutral: the previous revenues are somewhat recovered, Crane makes the same as last year and the logistics locations make $2.5M each the first year, they then struggle the second year and make $12.5M and the third year they reach the $20M. They make smaller acquisitions of $90M in revenue and the first year they contribute less to revenues. They are $50M or 5% shy of the 2028 goal.

In the neutral scenario, EBITDA margins improve from the current 11.5% to 12% in 2028, same purchase price for the acquisions and higher leverage at x2.5 Net Debt/EBTIDA. This results in a $10/share by 2028 and $8/share by 2026 target price.

Pessimistic: the previous revenues are somewhat recovered, Crane makes the same as last year, the logistics locations struggle as they do in the neutral scenario and the acquisitions are for $60M in revenue and they are pushed back a year.

Finally, the pessimistic scenario has margins dropping to 11% and staying at that level throught the 5 years that I have projected. Here the cost of acquistions is lowered to $60M each and therefore the debt level is higher at x3.25 Net Debt EBITDA.

In all scenarios I have considered that in the next capex replacement cycle, which should happen in 2026 and 2027, Titanium spends between $130M and $145M in renewing their fleet, and a tax rate of 30%.

Summary

In summary, Titanium is a fast-growing company with good management and capital allocation that has great growth prospects and the ability to see them through. They have both organic and inorganic growth, and they are trading at a discount versus the company’s history and its peers.

Disclaimer

This article is not a financial advice. I am not a financial analyst. If you are going to invest do it under your own risk and after doing the appropriate due diligence.

Updates

In this section you can find the most relevant news and updates from the company since the thesis was published. They are arranged in chronological order: