This is the first part of the HelloFresh thesis, in which I will explore HelloFresh’s business model, history competitive advantages and financial performance. The link to the second part is available at the end of this post.

You can read the first part of the thesis in Spanish here:

History and Business Model

Business Description

HelloFresh is a direct-to-consumer food-delivery company focused on higher quality products and providing convenience to the customers while creating a great eating experience.

HelloFresh operates through two segments: North America and International. However, it is better to view the business through their different activities. For each activity there is a leading brand, but the company also has some smaller brands, all of which comprise the vertical. They are:

Meal Kits: through the meal kits service, HelloFresh provides customers with weekly deliveries of the ingredients and step-by-step recipe for many different dishes. Customers subscribe to this service and once a week choose how many dishes, for how many people and the specific dishes they want delivered to their home. In this delivery they receive the locally produced, pre-portioned ingredients and the recipes to cook their food. The menu is designed by HelloFresh chefs to make an equilibrated diet. They also classify plates in different categories so as to better satisfy their customers. Classifications include vegan, star, ‘grandma’, gourmet, for Tupperware, street food, and family recipes among many others. The main brand in the segment is HelloFresh (HF), the original brand of the company and the most recognizable meal kit brand globally. Other brands include Green Chef, EveryPlate and Chefs Plate.

Ready To Eat: the ready to eat (RTE) service works very similarly to the meal kits service, with customers subscribing and receiving prepared meals in their homes which they can then reheat in the microwave. The key differentiation for this is the quality and freshness of the food. While other prepared foods have low quality ingredients, HelloFresh makes sure that their prepared foods are of the highest quality and are designed by chefs, like they do with their meal kit service. The RTE segment has two brands, the main one is Factor, which operates in North America, and the other one is Youfoodz, which operates in Australia and New Zealand.

The Pets Table: through the pets segment, HelloFresh expects to diversify its revenue source and look for further growth opportunities. They define this business as: “A personalized dog food service developed with veterinarians and designed to keep pets healthy and their parents happy”.

Good Chop: through this segment, the company provides high-quality meat and seafood to customers. They define the business as: “We offer personalized boxes with diverse American beef, pork, chicken, and seafood cuts, delivered straight to customers’ doors for ultimate convenience”.

The company operates under a subscription model, which means that it has high revenue visibility, especially among its more mature customer base and markets. Customers can cancel or even pause the subscription at any time, with effect taking place for next week’s deliveries so the company can produce more efficiently. The subscription nature of HelloFresh makes it a SaaS-like business in terms of revenue stability and visibility. This also means that HelloFresh can reduce food waste and operate with low inventory levels.

In this video, HelloFresh quickly explains their services and model:

History & Company Strategy

HelloFresh was founded in 2011 and has since grown to a multinational company acquiring many other brands and expanding into new synergistic markets.

In November 2017 they conducted their IPO in the Frankfurt exchange at a valuation of €1.7B. Just a few months later in March 2018 they acquired Green Chef, an organic meal-kit company based in the US, and in October 2018 they acquired Chefs Plate, a Canadian meal kit company. They also founded EveryPlate in 2018. At that time they established Green Chef as the more premium brand, HelloFresh as the high-quality brand and EveryPlate for the more value part of the market. The idea was to capture the demand of different customer groups.

In 2020 they acquired Factor, a RTE meal provider operating in the United States, and in 2021 Youfoodz, which operates in Australia. Both of these companies now form the RTE segment. Following the acquisition of both brands they applied what they learned from the meal kits and their operating structure to both brands. They called this the ‘meal kit playbook’. In just 2 years after the acquisitions, Factor had 5 times the production capacity and Youfoodz had 2.5 times the production capacity. Now they are expanding the factor brand into Canada and Europe, with a further doubling of production capabilities in North America in 2023. Following the acquisitions, the revenues and market share soared from €100M at the time of the acquisition (in 2020) to €1.4B in 2023, gaining 52% of the market in just 2 years.

They do not disclose much about the ‘meal kit playbook’ and what they do specifically. However, it can be assumed that they try to maximize efficiencies through things like buying locally-produced ingredients, automatization in production, and overall maximization of all processes possible. The results of this playbook are indisputable since it has allowed HelloFresh and the rest of the brands to grow and capture the market very quickly, which can be seen in the following chart:

HelloFresh has continued to capture the market, gaining a further 11% of the US market and another 9% of the international market as of 2022.

Market

The meal kit market is relatively new, with the first companies being founded around 2010. Since then, numerous companies have started operating in the market, making it a highly competitive environment. However, the market has been consolidating in recent years with multiple brands going out of business since it is quite hard to make a profit in these types of markets. HelloFresh has been able to do so, in part benefiting from an early mover’s advantage. The meal kit global market had a value of about $20B in 2023 and it is expected to reach $65B by 2030, for a CAGR of 15.5%. HelloFresh has stated that the RTE market is similar to the meal kit market, so we can estimate that it is also about $20B currently but it is expected to grow at a slower rate of about 7% to 9%.

Here is good explanation of the market and its characteristics in a short documentary made by the Wall Street Journal:

Competitive Advantage

In the industry in which HelloFresh operates the scale of the companies is quite important since there are a lot of fixed costs and once a player is established as the leading brand it takes quite a lot of marketing dollars and more importantly marketing and service efficiency to challenge the industry leader. HelloFresh enjoys these advantages of being market leader in the meal kits industry. This is why HelloFresh states that: “We have become the best D2C food operator with impenetrable competitive moats”.

The main competitive advantage that comes from having scale in this business is lower unit costs. By increasing scale, the fixed costs get diluted over a wider basis and therefore the cost per unit produced are reduced. This is why they state that “Opportunities outlined will provide us with ability to fulfil D2C orders at lower unit costs than anyone else in the meal kit, RTE or grocery industry”.

Another important point for the company is customer experience. They want to improve the customer experience as much as possible in order to drive out competition. For this, they have significantly increased the number of recipes available in the menu to over 100 in developed markets. Furthermore, they have added customizable recipes, where clients can add, swap or upgrade ingredients. The share of customizable recipes has grown from 9% at the end of 2021 to 43% at the end of 2022, with the target of hitting 60% in 2023.

Driving Efficiencies

HelloFresh was able to rise to the top of the industry while being profitable by constantly increasing the efficiency of their business. There have been many innovations and other actions to increase the efficiency, among the more important ones are planning menus algorithmically in order to balance customer demand an margin preservation, using extra production capacity in the meal kit sectors to grow the RTE meals segment, reducing food waste per euro of revenue (43% reduction from 2019 to 2022) and reducing plastic and mixed packaging per meal in grams (34% reduction in the same period).

Another interesting efficiency is that a few years ago they started to do the last mile deliveries, which are the miles with the higher cost. They currently do close to 25% of deliveries in-house and they plan to do more in the coming years since they are doing the last mile deliveries “at competitive price points”.

As a result of all the measures that HelloFresh takes to improve the customer experience and the efficiency of their business, the key metrics of the business have been improving in recent years. Some of them are shown below:

Financial Overview

Historical Performance

As a result of the previously mentioned competitive advantages, the acquisitions and the application of the meal kit playbook, revenues have grown significantly since the company was founded in 2011.

The graph ends in 2021, but growth continued with €7.6B in sales in 2022. However, 2023 has been a different year in terms of the competitive environment and the focus of the company regarding their business strategy and, as a result, revenues remained flat for the year.

In the years 2020 to 2022, the company saw explosive growth driven by both Covid and acquisitions, and to a lesser degree, international expansion of some businesses. This required investing greatly in new distribution centers and fulfillment centers to be able to serve all that extra demand. Although the company had already had positive FCF in some quarters, 2020 was the first year with positive FCF. They generated about €1.4B in FCF in those years that went to expanding the TAM of the meal kits by entering new markets, launching the RTE segment, expanding the fulfillment network and occasionally buying back shares. Here is a summary of the numbers of those years:

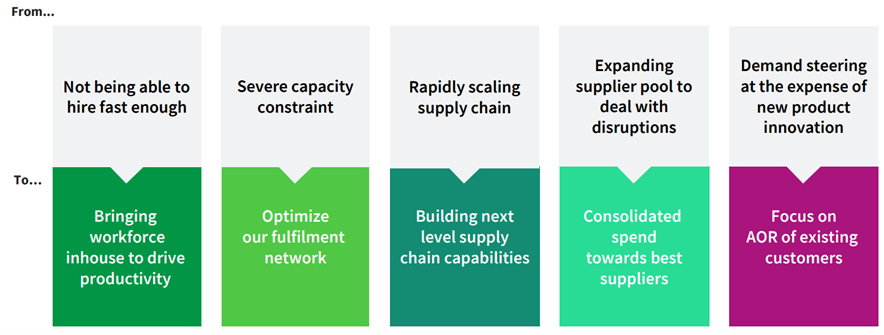

In 2023 things changed as the macroeconomic environment negatively impacted the market and the company had to focus more on profitability and adjusting the production capabilities to the actual sales level. This turned 2023 into a transition year, during which the company redefined their strategy and focused on maturing its customer base and consolidating the company while preparing for the ‘next leg of growth’.

Revenues and Profitability

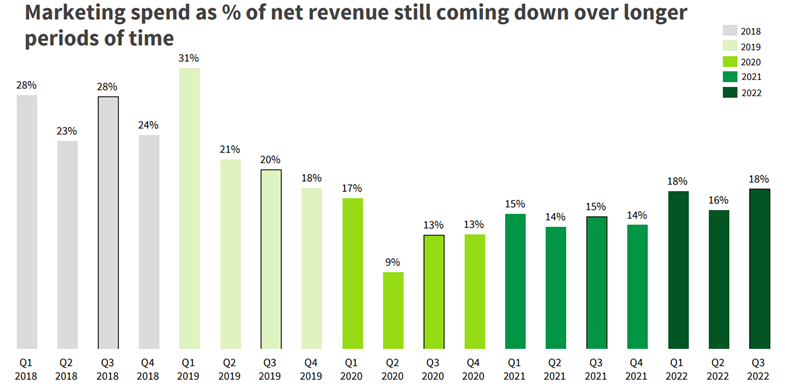

Revenue retention is very important for companies in the industry since the marketing costs only have to be incurred once per acquired client. If a client buys from the company a long time the marketing costs get distributed over a wider basis, which helps margins. If revenue churn is high, marketing costs will have to be elevated so revenue retention is key.

As can be seen in the graph above HelloFresh has decent revenue retention of the clients that start with an active subscription (not just testing the product).

Regarding profitability, there is a substantial difference between the businesses and their geographical location when it comes to the margins that those businesses have. Mature businesses, mainly the US market for meal kits, have EBITDA margins of 10%, while other businesses that are developing like Factor have lower 4% margins. Other new business lines like The Pets Table, Good Chop, and new geographies have negative EBITDA margins. EBITDA margins for the company as a whole has had the following margins:

The margin development is mostly a result of the full use of the production capability of the company and the reduced marketing spend during the Covid years.

In the graph we can see that in Q1 the marketing spend is higher, which makes EBITDA margins lower for the first quarter, giving HelloFresh some seasonality.

On another note, they provide adjusted EBITDA numbers, so it is important to focus on what those adjustments are. They are mainly adjustments for stock based compensation (SBC) and special items, which include M&A costs, restructuring or reorganization costs, and adjustments for intangible assets.

Regarding SBC, it is high, about $80M, which is never good. Nevertheless, given the alignment of management, which will be discussed later, and the performance of the business I don’t think it is too important, although it is certainly something to keep an eye on.

Cash Flows

Regarding cash flows, starting in 2020 a capex cycle started when the company had massive growth and was forced to invest more into new distribution and fulfillment centers. This cycle is now coming to an end as the company re-adjusts its cost base and more of the company’s markets enter a more mature phase. This is the reason why they state that: “Given our self-funded multi-year capex is coming to an end, we expect to deliver very attractive FCF/share from 2025 onwards”.

In their capital markets day in 2023 they outlined their capex expectations for the next years. They targeted €350M in capex for 2023, then €280M to €290M in 2024 and approximately €250M in 2025. HelloFresh reported €306M in capex for 2023, 12.5% below the initial expectations. The company also explained how the capex dollars were spent.

They recently released updated capex expectations with €285M expected in 2024 and then €200M from 2025 onwards. The capex for 2024 primarily comprises of RTE production capacity expansion into the US, Canada, and the European Union, completion of automated meal kit fulfillment centers, which was started in 2021 and 2022, developing in-house software and build some capabilities for the last mile delivery. For 2025, the capex will go down with most of it being dedicated to expanding the RTE segment. This reduction in capex plus the maturing of the customer base is expected to drive “attractive FCF/share expansion from 2025 onwards”.

Balance Sheet

HelloFresh has always had a net cash position before accounting for lease debt. Currently their net cash position is €207M. As a result, the interest payments are relatively low. HelloFresh issued a 5-year convertible bond on May 13, 2020, with a coupon of 0.75% paid semi-annually. The have stated that the maximum leverage they want to have is x1.75 net financial debt to adjusted EBITDA. With leases, this ratio sits at x0.84 for 2023.

Disclaimer

This article is not a financial advice. I am not a financial analyst. If you are going to invest do it under your own risk and after doing the appropriate due diligence.

Part 2

Please continue reading the HelloFresh thesis in this link: