You can read the thesis in Spanish here:

Note: this is the original thesis. You can access updates and new news about the company in the “Updates” section or at the end of this thesis, where you will find a link to all the updates.

Note: this research is based extensively on the research made by Donville Kent Asset Management (DKAM). They have talked with management to get more information, tested Reitman’s stores and many other things, which I have used throughout this analysis. The initial thesis can be found on their January 2023 letter and the updates on the following letters.

You can find the DKAM letters here:

Business Model

Reitman’s Canada is a Canadian retailer dedicated to the “sale of women’s specialty and apparel to consumers through its retail banners”. They currently have 3 brands: Reitman’s, Pennington’s and RW&Co. Reitman’s was founded in 1926 and operates 235 stores. It is one of the largest women’s specialty stores in Canada, serving about a third of Canadian women. They have an extensive size range. Regarding Pennington’s, it is a plus-size brand focused on “body diversity and size inclusivity” operating 91 stores. Finally, RW&Co, launched in 2000, operates 80 stores and is focused on fashions with an urban mindset.

The company also has an e-commerce segment, which accounts for 25% of the total sales. According to DKAM, they have a very good service with tracking numbers, receipts, confirmations, next-day delivery, etc. They also stated that “the company has invested significantly in its e-commerce websites and social media to drive consumers to the websites and believes that it is positioned well to compete in this environment”. “Over the past few months, we have experimented with buying from each site, shipping to multiple locations, and returning items. What we have found is a top tier online experience”.

“In our experiments, we experienced the following with the various aspects of the process:

Online ordering: immediate email confirmations.

Shipping: shipping confirmations and tracking numbers provided the same day as order.

Delivery: delivered next day for urban addresses, and within two days for rural.

Returns: ‘Returns’ button within order confirmation allows one to print return labels; notification received when it was delivered and refunded.

Much of the growth and margin improvement can be tied to their e-commerce abilities. Overall, the quality and growth of their e-commerce offering is one of the main drivers of their operating success” per DKAM.

Market

The retail market is highly competitive as there are no barriers to entry. Nevertheless, “the company believes it is well positioned to compete with any competitor”. This comes from the fact that the target market for Reitman’s is the overweight part of the population, with a special focus on women as they are more active clients. The overweight segment in Canada is growing at about 3% per year, making Reitman’s one of the few retailers that have favorable demographics.

Financial Overview

Covid Bankruptcy

On December 29th, 2019, the long-time CEO & President and member of the Reitman family passed away and was replaced by his brother. A few months later the covid lockdown pushed the company into bankruptcy. In this process the company was delisted from the TSX and relisted later on the TSV, where it is currently trading, they closed 30% of stores and laid off 1.600 employees. They also renegotiated leases on their stores, getting discounts of 10% in their main properties and up to 60% second-tier properties.

More importantly, they settled $195M in liabilities for a payment of $95M, roughly 50 cents on the dollar, and went from 5 banners to the current 3. The closed banners accounted for $164M in revenues and lost $1.1M.

During this process a new management team and board were appointed and for the first time in the company’s history the CEO is not a member of the Reitman family. Bankruptcy proceedings ended in January 2022.

Balance Sheet

Since the bankruptcy, the company has been accumulating cash on its balance sheet and has also repaid the outstanding balance on its revolving credit facility, which has a total balance of $115M and matures on January 12, 2025. They currently have about $100M in net cash.

Reitman’s has some real estate on their balance sheet. The real estate is located in Montreal and is an office and a distribution center. DKAM estimates that the office is worth $118.4M, although they later revised its value to $30M because the building is older than the average building on the market. The distribution center was built on 2001 and has 40 shipping docks and can process 55M units of merchandise per year. DKAM estimates that it is worth $123.5M plus the land upon which the building is located (approximately 1.1M square feet). The total revised real estate value is $153.5M or $3.02 per share (without accounting for the land of the distribution center).

They are also recognizing deferred tax assets. The definition of this is as follows: “a deferred income tax asset is recognized to the extent that it is possible that future taxable profits will be available against which they can be utilized”. It is an estimate of what the company expects its pre-tax profits to be in the future.

Revenues, Margins, Profits and FCF

The revenue per location and per square foot has been going up consistently, with a decline in fiscal 2021 (which was mostly natural 2020) and a significant increase in the following years because of the closure of two underperforming brands and other underperforming stores.

The revenues have seasonality with Q1 being the weakest and the majority of earnings being made in Q2 and Q4. 2023 was a very profitable year which will not be repeated in the coming years. This led to an increase in bonus payments of $20M. Those payments were down by $11.3M in the first nine months of fiscal 2024.

The company has also reduced its lease payments significantly:

The reduction in lease payments has resulted in an increase in margins. DKAM believes that “Reitman’s margins faced headwinds in 2020-2022 that we think have now subsided and the outlook is for gross margins to return to +60% like they were from 2011-2015”. The margins are highly impacted by input costs like cotton, shipping and forex. Regarding forex, the company suffered from a $11.4M negative forex impact in the first nine months of fiscal 2024. They have since entered into hedging activities to stabilize the exchange rate and eliminate forex impact.

Regarding profitability and cash generation, the numbers for the last quarters are as follows:

Adjustments: There are a few adjustments that need to be made here to normalize earnings. The first one is in Q4 of fiscal 2023, when there was an income tax recovery of $32M. The second one is in this same quarter, when most of the net cash from operations came from a release of working capital, which was reabsorbed in the next 2 quarters. This normalization corresponds to the cells with the grey background. Another adjusting item that needs to be taken into account for future projections is the payment of a $20M bonus for good store performance paid in the fourth quarter of fiscal 2023. This payment will not occur in future years as 2023 was an extraordinary year in terms of performance.

Another thing to note is that during the first nine months of fiscal 2024 there was a negative forex impact of $11.3M, which will not be ongoing as the company has now hedged its currency exposure.

Insiders, Incentives & Capital Structure

Capital Structure

The company has 2 types of shares: common shares and class A shares. There are 13.440.000 common shares and they have voting rights while there are 36.460.000 class A shares, which do not have voting rights. The company grants executives options for class A shares which have a dilutive effect of 1M shares and an exercise price of $2.63. The company is controlled by the Reitman family, as they own a majority of the common shares (58%) and therefore a majority of the votes. The total diluted number of shares is 50.9M.

Past Financial Operations

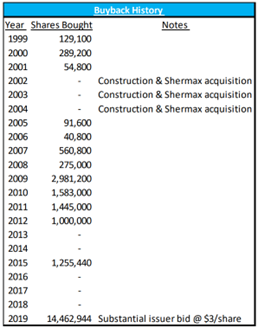

In the past, Reitman’s has done several interesting moves to increase shareholder value. One example is the purchase of 21% of NetStar Communications for $40M in 1995 and the later sale of 17% for $94M in 1999. The rest was sold later. This amount to a 30% CAGR. They also acquired a competitor in 1996 as a tax loss strategy and closed down the stores gradually. They have also made extensive repurchases throughout the years although DKAM says that many of them were done at too high prices. The repurchases were as follows:

The latest one and biggest was in 2019 and they spent a total of $45M. Regarding dividends, before the bankruptcy, their objective was to pay out 50% to 80% of earnings as a dividend. All in all, it is fair to say that the company has a tendency towards buybacks and dividends.

Incentives

The company approved a new bonus plan after bankruptcy proceedings, now bonuses are tied to operating profit less direct overhead. “However, these bonuses are a risk because the company is under Reitman family control. There is a possibility of excessive bonuses and unaligned economics. The bonuses were fairly large over the past two reported quarters. That being said, the company overall was still extremely profitable after this expense” – per DKAM.

Catalysts

There are several catalysts for the stock. These catalysts were proposed by DKAM in one of their letters and have been talked over with management. The DKAM research on Reitman’s was published in January and met with management in April. Furthermore, in October DKAM sent a letter to the board proposing several actions to increase shareholder value and help the stock move closer to its fair price.

First is the issue of the coattail provision. A coattail provision entitles the holders of the non-voting shares to convert their shares into voting shares in the event of a takeover.

All of the catalysts and actions to be taken were explained in the letter sent to the board and they are the following:

Uplisting to the TSX: uplisting the shares to the TSX allows many investment funds to invest in the stock, since due to regulations they cannot invest in companies listed on the TSV. The uplisting will also drive more attention to the company which will make the stock move closer to its fair price as well as increase the volume of the stock.

Elimination of the dual class share structure: converting the common shares into class A shares simplifies the capital structure of the company and solves the no-coattail issue. DKAM has talked with many different potential investors, and many have said that the dual class share structure is holding them back. They suggest converting common shares to class A shares at a premium of 50%, which would leave the company with 56M shares and the Reitman’s controlling 21%.

Share buyback: They propose a share buyback given the low stock price and also for the Reitman’s to regain control of the company. For that they need to repurchase 32.4M shares. DKAM proposes several buyback plans.

Investor relations department: DKAM has become the de facto investor relations department. They suggest establishing a proper investor relations department with conference calls, presentations, seek analyst coverage, etc.

Monetization of Real Estate: DKAM proposes that Reitman’s Canada does a sale leaseback of their office and distribution center to the Reitman family. This is also not unprecedented for the company, since they did a sale leaseback on their distribution center handling equipment in 2003.

Special Dividends: as an alternative to share buybacks, which may be complicated due to low volumes, they propose that after the monetization of Real Estate they can pay a special dividend to shareholders to make use of that cash.

DKAM has also made some comments in the letters regarding management’s position in all of these ideas. Here are some of these comments.

“Investors may have been expecting announcements around capital allocation or up-listing to the TSX. After speaking with management, they are ahead of plans and those decisions have come up faster than expected. We have spoken with some institutions who are interested in investing but are precluded by the venture listing. We fully expect the uplisting to the TSX to be front and center and we’re going to push for that to be a priority.”

“The most important aspect to stress from our meeting with management is the change in management mentality over the past 2 years. … This has led to a focus on per store profitability which we think is the number one reason for continued profitability going forward. Incentives are now aligned because they focus on per store profitability plus the strategy isn’t a quest to expand and grow for growth’s sake. Additionally, there is no longer pressure from the top to build a war chest of cash. We think this leads to interesting capital allocation decisions later this year.”

“Management seems to be on board to uplist to the TSX and their next two quarters are their seasonally most profitable which should show the ability to be consistently profitable each year. These should be the catalysts needed to rerate the stock much higher.”

By DKAM

Finally, at the end of the letter to the board the threaten the board in case they don’t do any of the things proposed. The threatening phrase is the following: “As shareholders, we trust that the Board has our best interests in mind and will comply with their fiduciary responsibilities”.

Risks

Reitman’s faces many risks, some more possible than others. Among them are:

The fact that the company only has one distribution center can cause problems if anything happens to it.

As leases start being renegotiated, higher lease prices can result in a reduction in profits.

Reitman’s imports over 90% of their merchandise from Asia. One supplier accounted for 10%, but there is a variety of alternative sources, national and international, for virtually all of the company’s merchandise. This risk would not impact the company in any significant way.

Competitors

With respect to Reitman’s competitors, the three brands of Reitman’s Canada have multi-decade upwards search trends on Google, while competitors like the Gap, J. Crew, Holt Renfrew, Hudson’s Bay Company or Banana Republic have either flat or downward trends.

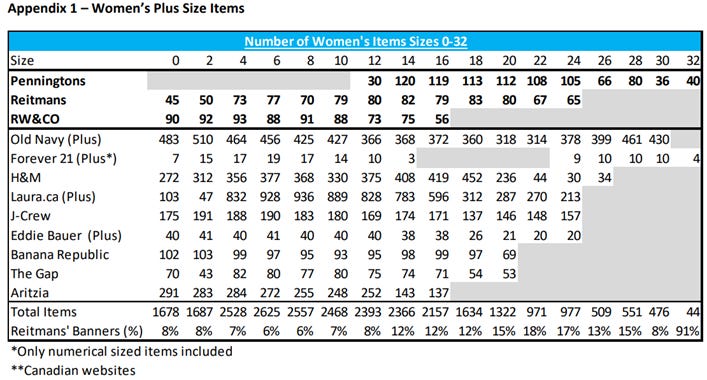

In terms of their competitive advantage in their target market (overweight females), this chart clearly shows that they are the go-to retailer for this segment of the market:

Summary

All in all, the final value of Reitman’s depends significantly on what management decides to do with regards to the cash on the balance sheet, the uplisting and other catalysts. If they do nothing, the business alone is worth $8/share and if they follow the plan that DKAM has laid out, the stock could be worth up to $17/share (including the unification of the share classes at a 50% premium). I also think that having the backing of an investment fund like DKAM in this situation will help pushing the company into its correct valuation, since the catalysts needed for the stock can only be proposed seriously by an investment fund and they have the power to see them through.

Valuation

Since the company’s free cash flow after accounting for lease payments is higher than normalized net income the best multiple for valuing Reitman’s is price to free cash flow. From 2010 to 2019 Reitman’s averaged x7.7 p/fcf.

DKAM also found that a competitor was recently acquired. “Recent Chico’s women’s clothing takeout by Sycamore Partners that was announced in September. Private equity firm Sycamore Partners is paying $938m, which equates to 11x PE multiple. Reitman’s has higher gross profit, operating margins, net margins, plus a better balance sheet”.

DKAM also made a list of the different competitors and the multiple they are trading at:

For fiscal 2024, the first 3 quarters the company made $6.76M in adjusted FCF. Adding that to the $11.3M negative forex impact we arrive to the normalized adjusted FCF of $18.06M for the first 9 months of fiscal 2024.

In the fourth quarter I expect sales of about $200M with a gross margin of 56% and $89M in selling & distribution expenses (down $11.4M because of the reduction in the incentive plan) and $12M in administrative expenses, which leaves $11M in result from operating activities and $11.23M in net income. Adding $3.3M in depreciation of assets and $8.5M in depreciation of right-of-use assets and subtracting lease payments for $9.5M and $3M in capex we get the figure of $10.53M in FCF before working capital changes. The company has been releasing working capital this past 2 years, at about $1M per quarter. This leaves the FCF at $11.53M. And final cash for the year should be about $110M.

With all of this, the normalized level of FCF for 2024 is about $30M. As you can see above, FCF is quite similar to net income so we can use p/e and p/fcf indistinctively. With the multiples above you can see that they are slightly higher than 10. Using that 10 p/e the business is worth $300M, plus the $100M in cash.

Here is an estimate of the various cases based on the company’s capital allocation decisions:

All things taken into account, DKAM estimates that with no value being created from cash and the real estate the stock is worth $8 and after a share buyback, sale leaseback of the real estate and a ‘continued trajectory of operating performance’ the stock could be worth $12+. With my projections this seems reasonable. The time to achieve this is more uncertain, although I believe that a three-year period for uplisting and the stock reflecting the true value of the business is a conservative period of time.

This article is not a financial advice. I am not a financial analyst. If you are going to invest do it under your own risk and after doing the appropriate due diligence.

Updates

In this section you can find the most relevant news and updates from the company since the thesis was published. They are arranged in chronological order:

Any updates on this ?? Great work