You can read the thesis in Spanish here:

Note: this is the original thesis. You can access updates and new news about the company in the “Updates” section or at the end of this thesis, where you will find a link to all the updates.

What does the company do?

Learning Technologies Group (LTG) is a provider of learning services and software for businesses. They sell their SaaS products and also have transactional revenues (they bill clients for a specific project). SaaS products include DE&I, Data & Analytics, remote learning systems, talent management, corporate learning content and games and immersive learning. They have a variety of agencies that can work together or separate, but since the GP acquisition all services will be offered via 1 GP Strategies contract and GP will become the market-facing brand.

The history of the company’s brands and acquisitions is as follows:

Epic bought by Andrew Brode (Chairman) and Jonathan Satchell (CEO) in 2008 and taken public in 2014 via SPAC merger.

Revenue goal of £50M by 2018 established. Bought LINE, a designer of learning solutions, and merged it with Epic to create LEO Learning. Epic’s cloud-based authoring tool Gomo launched into market.

Acquired PRELOADED, an educational games company.

Acquired Eukleia, e-learning for financial services focused on Governance, Risk & Compliance (GRC).

Acquired Rustici Software, a company that connects different e-learning platforms and other platforms with external sources.

30% of Watershed acquired. Created by founders of Rustici to exploit data obtained. Watershed sells SaaS learning analytics to assess effectiveness of learning programs.

Acquired NetDimensions, a talent management software platform provider.

£50M revenue goal met in 2017.

New goal of £100M in revenue and £25M in adjusted EBIT by 2020.

Acquired PeopleFluent, a provider of cloud-based integrated talent solutions focusing on all aspects of the employee lifecycle.

NetDimensions integrated into PeopleFluent.

Affirmity separated from PeopleFluent. Affirmity is the workforce compliance and diversity division.

Remaining 70% of watershed acquired. Now LTG has full ownership.

Vector VMS separated from PeopleFluent. Vector VMS provides tools to manage contingent workforce.

Met EBIT goal (£26M) and very close to revenue goal (£96M) in 2018.

New goals of £200M in revenue and £55M in Adj. EBIT by 2021.

Acquired Breezy HR. Breezy HR provides small to medium businesses with feature-rich, intuitive and user-friendly recruitment software in order to optimise their processes and maximise productivity.

Launched new brand Instilled. Instilled is a sort of social media platform for learning, where one can share knowledge with others, ask questions, etc. (Similar to LiveChat’s KnowledgeBase).

Updated targets to £230M in revenue and £66M in Adj. EBIT by 2022.

Acquired Open LMS (Learning Management Systems). Open LMS is the largest commercial Moodle provider in the world. (Moodle is open source).

Eukleia integrated into LEO Learning and renamed to LEO GRC.

Acquired eCreators, Australia’s largest Moodle provider and integrated it into Open LMS.

Acquired eThink, North American commercial Moodle leader and integrated it into Open LMS.

Acquired JCA solutions, a Rustici competitor that will be integrated into it.

Revenue goal met in 2021 and EBIT goal met in 2022.

Established current revenue and EBIT goals (explained below).

Acquired Reflektive, a company that specializes in engagement and analytics tools.

Acquired PDT Global, a leading provider of DE&I solutions. They focus on consultancy.

Acquired Bridge, a performance and skills development platform for mid-sized organizations. Complementary to PeopleFluent, which serves large companies, and Breezy that serves small to medium companies.

Acquired GP Strategies, a leading learning services and workforce transformation provider, giving the company ample opportunities for cross selling and a big new customer base.

Effective People separated from GP Strategies. Effective people is a software implementation division.

LEO Learning integrated into GP Strategies’ learning experience division.

PDT Global integrated into GP Strategies’ DE&I division.

LTG now plans to reduce the number of companies they own by integrating ones into others. They plan to integrate LEO, LEO GRC, PRELOADED and PDT Global into GP Strategies and Instilled, Gomo and Reflektive into Bridge. They also want to provide all services through one GP Strategies contract in case that more than one LTG company is involved.

All in all, LTG provides “An ecosystem of learning and talent tools, systems, platforms and expertise that enables learning and talent transformation” using “Modern learning strategies, content, experiences and delivery approaches that optimise workforce performance” by “Aligning vision and strategy to deliver integrated and systemic business results to drive growth and change through people”. In the intersection of consulting, learning services and technology is where LTG’s unique value lies.

LTG operates in the Corporate Training market, which is about $400B. They focus on the external training segment ($108B) while also providing some services to the internal training segment. LTG´s market is highly fragmented. This is because it is very hard to create one Learning Management System that is useful for all companies. They also have a significant portion of the business in the talent management industry.

Financial overview

Historical Performance

LTG has historically grown via acquisitions. They purchased competitors with low margins and integrated them and improved their margins significantly. This way they can quickly pay for acquisitions and move on to the next one. This has resulted in 2014 to 2022 CAGRs of 59% for revenues, 63% for adjusted EBIT and 47% for diluted EPS.

Revenues

Most of the revenues come from the US and they are recurring, so LTG’s revenues are quite stable and predictable.

They are also well diversified among clients. The Top 15 clients represent 50% of revenues and have an average tenure of 14 years, with 93% of them receiving more than one service from LTG. The Top 50 represent 75% of revenues, with 60% receiving more than one service. They are also well diversified among sectors:

There are 3 main segments: GP Strategies, Software & Platforms (SaaS) and Content & Services (Transactional). The SaaS segment has £150M in revenues with margins of 27% and Transactional has £50M in revenues and margins of 24%. GP Strategies is currently a separate segment, but they will be integrated when margins are normalized.

GP Strategies Acquisition

In 2021, LTG acquired GP Strategies, a US company with revenues of £400M, twice what LTG was making. GP had very low margins (about 5%) and LTG planned to improve them post-acquisition. In 2022 they averaged 12.2% with an exit rate of 14% in Q4. The market did not like this acquisition and doubted LTG’s ability to improve its margins and the stock fell -61.5% from 200 pence to about 77 pence (current price).

Adjusted EBIT, diluted EPS and Cash Conversion

EBIT is typically lower than adjusted EBIT because of the way that LTG grows. There are usually acquisition related costs. Cash conversion sits at around 85% before capex. Diluted EPS has grown slower than EBIT because to achieve such growth they have had to issue shares to purchase the acquired companies, as the company was too small to secure loans from banks or private placements of debt. This is unlikely to continue in the future, as they have achieved significant scale. As it is an asset light business, the return on equity is good, about 15% in the last few years.

Growth Strategy

2025 Targets

LTG aims to achieve £850M in revenues and £175M in adjusted EBIT (21% adjusted EBIT margin) by 2025 with a Net Debt/EBITDA of 1x to 1.25x. They plan to achieve this with 5% organic growth and acquisitions focused on the SaaS part of the business, which is more stable and predictable. SaaS contracts average 2.5 years and long-term contracts average 5 years. Organic growth is expected to be at 5%.

Implicit in the Long-Term Incentive Program (LTIP) is the adjusted diluted EPS target, which is 14.5 pence per share. This is the level at which management would get 100% of the bonus from the LTIP. With the assumptions that LTG gives (7% interest costs and 27% tax rate) they also imply that the share count will not increase.

It is also worth mentioning that they have achived all their set goals before the year that they initially said, except for the EBIT goal for 2022, which they completed on time.

Growth plan

The current growth plan has two main parts: optimization of revenues of GP Strategies and further acquisitions. The company has stated that they have about £220M of ‘firepower’ for acquisitions at 1x Net Debt/EBITDA. With 1.25x Net Debt/EBITDA they could have £265M for acquisitions.

Regarding optimization of revenues, LTG has developed a 5-point growth plan. The points are the following: optimization of GP revenues (increased sales to current customers and cross-selling LTG products), cross-selling of GP products to LTG clients, geographic expansion, new offerings and focused new client acquisitions.

Acquisition Strategy

LTG has historically grown through acquisitions, and they plan to do so in the future as well. These acquisitions have been very accretive, as they are able to improve margins significantly after taking control of the acquired companies.

The current plan is to spend another £220M in acquisitions and focus on SaaS and long-term contracts to rebalance the revenue mix towards recurring revenues.

“We plan to fund these investments through a combination of internally generated cash and debt, while maintaining a net debt/adjusted EBITDA covenant range of 1x -1.25x. We are committed to achieving these goals without resorting to equity funding”.

LTG aims to acquire businesses with 4 qualities: strong management, new market or sector access, complementary products or services, and founder-led growth.

Here is a more comprehensive explanation of what they target when looking at a possible acquisition:

Insiders & Shareholder treatment

Insiders are well aligned with the company, with the CEO (Jonathan Satchell) owning 9.3% of the shares and the Chairman of the Board (Andrew Brode) owning 14.8%. Insiders as a whole own 25% of LTG.

Insider salaries are very low in comparison to share ownership. Andrew Brode has no salary and the rest of insiders own at least 10x as many shares as they receive in salary. Jonathan Satchell’s ownership is x36 salary and Piers Lea is x15. The others are non-executive directors and board members (except for Kath Kearney-Croft, who joined LTG recentl) and do not play as significant a role as the members that are aligned with shareholders.

Long-Term Incentive Program (LTIP)

The company approved the LTIP in August 2021. In the program, 5 key personnel received options that vested upon the completion of certain criteria. All options have a strike of 0.375 pence.

The options were granted as follows:

Jonathan Satchell (CEO) -- 6M

Kath Kearney-Croft (CFO) -- 3M

Piers Lea (Chief Strategy Officer) -- 3M

Claire Walsh (General Counsel and Company Secretary) -- 1.5M

Nick Bowyer (COO) -- 2M.

The total options granted were 15.5M.

Half of the options vest in 4 years since the approval of the LTIP and the other half in 5 years. Two-thirds of the options depend on Total Stockholders Return (TSR) and the other third depends on diluted EPS. For each of these criteria, if the CAGR is 10% or less they receive 0% of the bonus, if it is 20% they receive 50%, and if it is 25% or more, they receive 100%. If the CAGR sits anywhere in between 10% and 20% or 20% and 25% there is a straight-line vesting of the options.

The stock declined significantly after the plan was announced due to the market’s skepticism about the GP Strategies acquisition, so annualized returns have gone up significantly in order for the stock to achieve the level at which management would receive 100% of the bonus.

The base EPS for the LTIP is 4.294 pence and 169 pence for the share price. The needed EPS to reach 100% of the bonus is 10.48p in 4 years and 13.104p in 5 years. Similarly, the share price has to be 412.6p in 4 years and 515.75p in 5 years. However, two years have already gone by, so the metrics have to be achieved in 2 to 3 years.

Dividends

They have been paying a 2% dividend (1.6 pence per share). LTG has been increasing the dividend for several years now. “The Board remains committed to a progressive dividend policy”.

Risks

Decline in transactional revenues: during economic crises companies tend to put off one-time learning services. This affects what LTG classifies as transactional revenues, and they can decline 50%+ in a crisis. They are looking to make an acquisition to increase the share of more stable SaaS and long-term contract revenues.

Key management leaving: if Andrew Brode (Chairman) or Jonathan Satchell (CEO) leave, new management may not be able to achieve the same results as they have. Although this is unlikely because they own a big part of the company, them leaving could pose a threat to the company’s future.

Technological disruption: this is not a big risk as the learning services sector is quite stable, but any competitor could at some point create a technology that disrupts the market and damages LTG’s revenues.

Integrating acquisitions: It’s possible that in a specific case they can have problems integrating an acquisition and they are not able to improve their margins. This risk was perceived as high by the market when LTG bought GP Strategies.

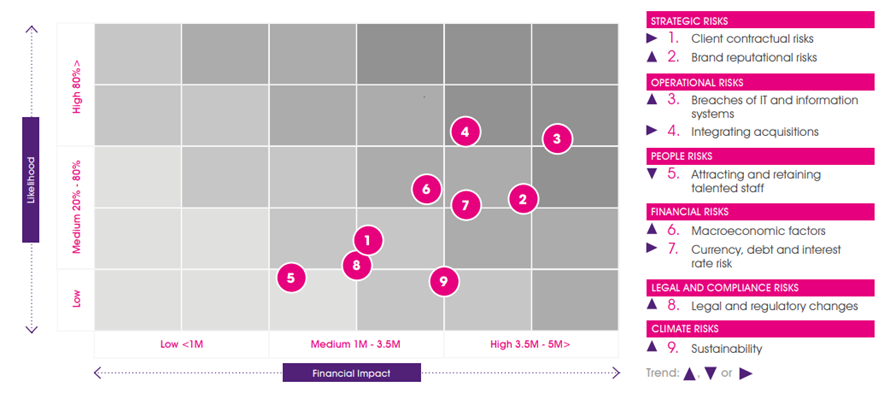

LTG lists their risks in the following table:

Competitive Advantage

Scale: as LTG grows and they incorporate new products and services, they create a moat in the form of scale as they are able to offer more under the same contract, which also results in lower costs and more competitive pricing

Management team: they have managed the company outstandingly since its inception, creating a lot of value, even in per-share terms, having a great capital allocation and integrating companies and improving their margins significantly. They have made highly accretive acquisitions and diluted shareholders only to increase value per share. All of these coupled with the alignment with shareholders, creates a significant competitive advantage that other competitors do not have.

Competitors

In an interview in 2019 Jonathan Satchell said that they do not have a direct competitor in the sense that there is no other company that provides as wide an array of services as LTG does. They have competitors in their specific business segments. This reduces the competition risk significantly as any possible disruption is mitigated.

The closest competitor is BTS Global AB. They have had lower revenue growth, lower EBIT and Net Income margins. Cash conversion and capex/revenue are similar to LTG’s. BTS has been trading at an EV/EBITDA of x11.5 in the past 10 years while being a lower quality business.

Overall Outlook

LTG’s aligned management has created high value per share via acquiring companies and improving their margins and only diluting shareholders when it was accretive. The recent decline in the stock was due to the market’s skepticism about the GP Strategies acquisition, and later the slowdown in revenues in H1 2023.

Valuation

Current multiple is 9x adjusted earnings. This is the historical p/e (adj.) multiple:

For a company with such a growth history even in per-share terms, I think that an adequate multiple can be x25 – x30 earnings and x32 – x40 FCF. Nevertheless, the company’s average p/e has been x37. It is currently trading at its lowest multiple since inception with similar growth prospects in the future. (All adjusted earnings).

This article is not a financial advice. I am not a financial analyst. If you are going to invest do it under your own risk and after doing the appropriate due diligence.

Updates

In this section you can find the most relevant news and updates from the company since the thesis was published. They are arranged in chronological order: